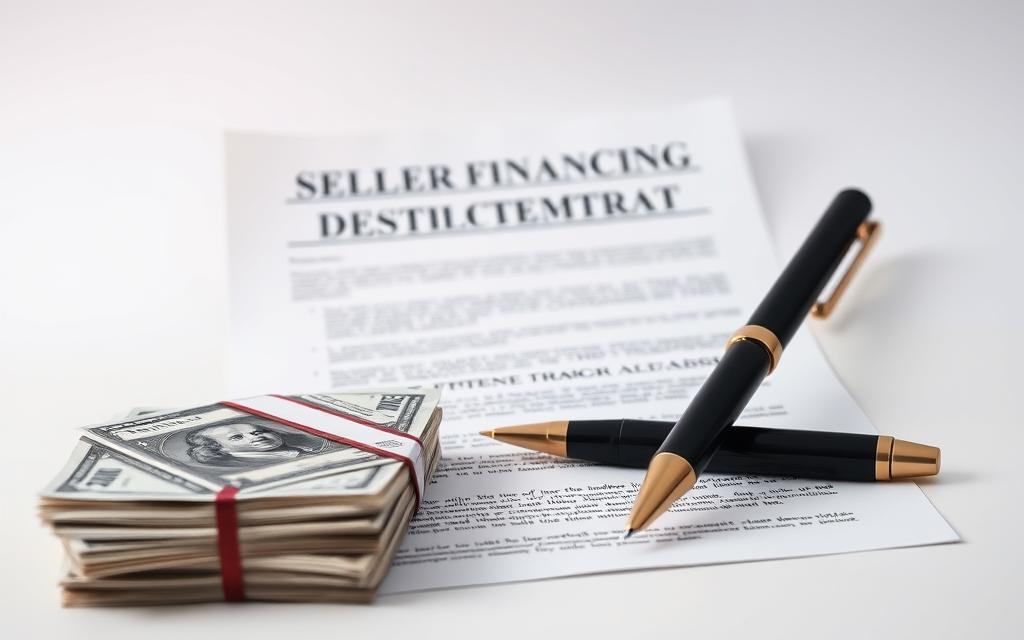

Seller financing, also known as ‘owner financing’ or ‘seller carryback’, is a common practice when selling a business. It involves the seller offering a loan to the buyer to cover part or all of the sale price, which is then repaid in regular instalments.

Approximately 90% of small business sales in the US involve some form of financing from the seller. This comprehensive guide will explore whether seller financing can legally charge interest and what rates are typically applied.

We will examine the fundamentals of business financing, the legal framework governing interest charges, and the benefits and risks for both buyers and sellers, including tax implications and protection mechanisms.

Understanding Seller Financing in Small Business Sales

Seller financing has emerged as a vital component in facilitating small business transactions. It represents an arrangement where the business seller acts as a lender, providing a loan to the buyer to facilitate the purchase of their business.

What Is Seller Financing?

Seller financing functions like a standard commercial mortgage, except the funding is provided by the seller, not a financial institution. The business owner self-finances part of the sale price, effectively providing a private mortgage to the buyer.

The terms and conditions of seller financing can vary significantly depending on the seller’s preferences. Typically, the seller demands a down payment of at least 10% and funds up to 60% of the balance remaining.

| Key Features of Seller Financing | Description |

|---|---|

| Direct Financial Relationship | Creates a direct financial relationship between the buyer and seller that continues after the sale closes. |

| Financing Percentage | Typically covers between 30-60% of the total purchase price. |

| Prevalence in Small Business Sales | Features in approximately 60-90% of small business transactions. |

By understanding seller financing, buyers and sellers can navigate small business sales more effectively. This financing method benefits sellers by expanding the pool of potential buyers while offering buyers access to funding that might otherwise be unavailable.

How Seller Financing Works in Practice

Seller financing is a flexible method for buyers to acquire a business by making regular payments to the seller over time. This arrangement benefits both parties, as the seller receives a steady income stream, and the buyer can purchase the business without needing the full purchase price upfront.

The process typically begins with the buyer making a down payment, usually between 10% to 30% of the purchase price. The remaining balance is then structured as a loan from the seller, documented through a legally binding promissory note.

The Basic Structure of a Seller Financing Deal

A seller financing deal is typically structured with several key components. The buyer provides a down payment, and the remaining amount is covered by a promissory note, outlining the terms of the loan, including the interest rate and payment schedule.

- The buyer makes regular payments, usually monthly, which include both principal and interest.

- Security for the loan is often provided through a UCC-1 lien on the business assets.

- A personal guarantee from the buyer may also be required to protect the seller’s interests.

To illustrate the structure of a seller financing deal, consider the following example:

| Component | Description |

|---|---|

| Down Payment | 10-30% of the purchase price |

| Promissory Note | Outlines loan terms, including interest rate and payment schedule |

| Regular Payments | Monthly payments including principal and interest |

| Security | UCC-1 lien on business assets and/or personal guarantee |

Can Seller Financing Charge Interest on a Small Business?

In the context of small business sales, seller financing is frequently used, and charging interest is a standard aspect of such financing arrangements. When a seller provides financing to a buyer, they are essentially acting like a bank, and as such, they are entitled to compensation for the risk they undertake and the time value of money.

The question of whether seller financing can charge interest on a small business is answered affirmatively. Yes, it can, and it is a common practice. The interest rate charged can vary based on several factors, including the risk involved in the transaction.

Legal Framework for Charging Interest

The legal framework governing interest charges in seller financing is primarily determined by state usury laws. These laws set maximum allowable interest rates for loans, including seller financing arrangements. While these laws vary by state, most seller financing deals for business sales are categorized under commercial loans, which typically have higher maximum allowable rates compared to consumer loans.

- Seller financing can legally charge interest on small business sales, and it is standard practice.

- The seller acts like a bank or lender, entitled to compensation for the risk and time value of money.

- State usury laws govern the interest rates that can be charged.

Over the past decade, interest rates on promissory notes have ranged from 6% to 8%, depending on the risk involved. Sellers must ensure their rates comply with state laws while reflecting the transaction’s risk profile.

Determining the Right Interest Rate

Determining the right interest rate for seller financing is crucial in small business sales. The interest rate can significantly impact the overall cost of the business for the buyer and the return on investment for the seller.

When determining the interest rate, several factors come into play. Unlike traditional bank loans or mortgages, seller financing interest rates are typically higher, ranging from 6-10%, to compensate for the increased risk the seller assumes.

Factors Influencing Interest Rates

The key factors influencing the interest rate include the buyer’s creditworthiness, business experience, size of the down payment, overall purchase price, and the general financial health of the business being sold. For instance, a buyer with a good credit score and significant business experience may qualify for a lower interest rate.

- Balancing market conditions with risk assessment is essential in determining the appropriate interest rate.

- The prevailing prime rate and current commercial lending rates provide a baseline for seller financing rates.

- A larger down payment can justify a lower interest rate, reducing the seller’s risk exposure.

The interest rate is more a function of the risk than the current cost of money. Therefore, it’s essential to assess the buyer’s financial position, business experience, and credit score when determining the interest rate.

Typical Terms of Seller Financing

Seller financing agreements usually involve specific terms that are designed to protect both the buyer’s and seller’s interests. These terms are crucial in ensuring that the transaction is fair and manageable for both parties.

The terms of seller financing can be broken down into several key components. One of the primary aspects is the down payment, which is typically substantial, ranging from 30% to 60% of the total purchase price.

Down Payment Requirements

A significant down payment provides security for the seller and demonstrates the buyer’s commitment to the purchase. The exact percentage can vary based on the negotiations between the buyer and the seller.

The loan duration for seller financing generally spans 5 to 7 years, although it can be shorter or longer depending on the size of the transaction and the parties’ needs. Repayment schedules are typically structured as monthly payments with amortisation over the loan term.

| Term | Typical Range | Description |

|---|---|---|

| Down Payment | 30% – 60% | Percentage of the purchase price paid upfront |

| Loan Term | 5 – 7 years | Duration of the loan |

| Interest Rate | 6% – 10% | Rate of interest charged on the loan |

It’s also common for seller financing agreements to include balloon payment structures, where the buyer makes regular payments for a period followed by a larger final payment. The terms must be structured to ensure the business generates sufficient cash flow to cover both the loan repayment and provide the buyer with adequate income.

Benefits of Seller Financing for Buyers

The advantages of seller financing for buyers are multifaceted and significant. By providing an alternative to traditional bank financing, seller financing opens up new avenues for buyers to acquire businesses.

Seller financing significantly expands a buyer’s purchase options. It allows buyers to access businesses that might otherwise be unattainable due to stringent bank loan requirements. Buyers with limited capital or credit history can leverage seller financing to acquire businesses that would typically require larger down payments or more extensive credit histories.

Increased Purchase Options

Seller financing provides buyers with more flexibility in terms of financing and repayment structures. The qualification process is generally more streamlined than traditional bank loans, focusing on the buyer’s industry experience and business plan rather than strict financial metrics. This enables buyers to negotiate more favourable terms, including lower interest rates or longer repayment periods, tailored to the business’s cash flow.

Ultimately, seller financing enables buyers to achieve higher returns on investment through improved cash-on-cash returns, as they can retain more working capital for business operations. This makes seller financing an attractive option for buyers looking to maximise their investment potential.

Benefits of Seller Financing for Sellers

By providing seller financing, sellers can expand their buyer pool and achieve better sale outcomes. Seller financing allows buyers to purchase a business without needing to secure a large loan from a bank, thereby attracting more potential buyers and possibly achieving a higher sale price.

Seller financing offers several key advantages to sellers. It enables them to sell their business at or above the asking price, avoiding the need for discounts. Moreover, it provides tax advantages as it is considered an instalment sale, allowing sellers to spread the capital gains tax liability over the term of the contract.

- Offering seller financing can result in a sale price 10-30% higher than businesses sold for all-cash transactions.

- Sellers attract more qualified buyers who might struggle to secure traditional financing.

- The tax benefits are substantial, as capital gains tax is paid only on the instalments received each tax year.

Attracting More Potential Buyers

Seller financing opens the door to a broader range of buyers, including those who may not have the cash reserves for an all-cash purchase. This increased demand can drive up the sale price and lead to a more favourable sale outcome for the seller.

“Seller financing is a win-win for both parties, as it allows buyers to acquire businesses they might otherwise not afford, while sellers benefit from a potentially higher sale price and ongoing income through interest payments,” said a financial expert.

Protecting the Seller’s Interests

Protecting the seller’s interests is paramount when offering financing options for small business sales. Sellers must take a proactive approach to mitigate potential risks associated with buyer financing.

A critical step in protecting the seller’s interests is the thorough vetting of potential buyers. This involves reviewing their credit reports, business experience, financial statements, and references from previous business relationships to assess their creditworthiness and ability to manage the business successfully.

Vetting Potential Buyers

Vetting potential buyers is essential to ensure that they are capable of fulfilling their financial obligations. Sellers should also draft a comprehensive promissory note that includes clauses addressing non-payment and late payments.

- Creating a comprehensive promissory note with clear terms regarding payment schedules and default provisions.

- Securing the loan with business assets through a properly filed UCC-1 financing statement.

- Obtaining personal guarantees from the buyer and potentially their spouse to provide additional security.

To further safeguard their interests, sellers should consider requiring buyers to maintain specific financial benchmarks and provide regular financial statements. This allows the seller to monitor the business’s health throughout the loan term.

| Risk Mitigation Strategies | Description | Benefits |

|---|---|---|

| Comprehensive Promissory Note | Clear terms on payment schedules and default provisions | Legal protection for the seller’s financial interests |

| UCC-1 Financing Statement | Securing the loan with business assets | Priority claim on assets in case of default |

| Personal Guarantees | Buyer’s personal liability for the debt | Additional security beyond business assets |

Handling Buyer Defaults

When a buyer defaults on a seller-financed loan, the seller must be prepared to take action to protect their interests. A comprehensive default clause in the seller financing agreement is essential to clearly define what constitutes default, typically including missed payments, breach of covenants, or material misrepresentations.

Including Default Clauses in Agreements

To mitigate potential losses, sellers should ensure that the original sale agreement outlines their ability to take back the business in case of default, including provisions for the transfer of licences, leases, and other critical business assets. For instance, if a buyer defaults on their loan, the seller can repossess the business by following the procedures outlined in the agreement.

- Comprehensive default clauses should be included in seller financing agreements to define what constitutes default.

- Sellers have several options when a buyer defaults, including restructuring payments, accelerating the loan, or repossessing the business.

- The seller’s ability to regain operational control must be explicitly outlined in the original sale agreement.

For more information on handling buyer defaults and default remedies, you can refer to resources such as this guide. By including robust default clauses and understanding their options, sellers can better protect their interests in the event of a buyer default.

Combining Seller Financing with Other Funding Sources

Seller financing is rarely used in isolation; it is typically combined with other financing options to facilitate a smooth business acquisition. Few sellers will self-finance 100% of the sale price of their business, which means buyers often need to come up with 30% to 50% of the purchase price through other means.

Most seller financing arrangements cover only a portion of the purchase price, typically between 30-60%, requiring buyers to combine this funding with other sources to complete the transaction. To fill this financial gap, buyers can explore various financing options.

Bank Loans and SBA Financing

Bank loans can complement seller financing, as many lenders are more willing to provide funding when they see the seller has confidence in the business through their willingness to offer financing. SBA loans, particularly programmes like the SBA 7(a) loan, are often used alongside seller notes to fund business acquisitions up to £5 million.

The standby agreement is a critical component when combining bank and seller financing, requiring the seller to subordinate their loan to the bank’s loan and potentially defer payments if the business experiences financial difficulties. Alternative lending options, such as equipment financing, inventory financing, or revenue-based financing, can also be combined with seller financing to create a comprehensive funding package tailored to the specific business being purchased.

Selling the Seller Note for Cash

Sellers often consider selling their seller financing note to obtain immediate cash. This option can be particularly appealing to those who prefer a lump sum payment over a series of payments over time.

Selling a seller financing note involves transferring the right to receive future payments to an investor. The sale price is typically determined by the note’s remaining balance, interest rate, and payment history.

When and How to Sell Your Note

The timing of the sale is crucial. Sellers can often sell their note after it has matured for six to 12 months, once a payment history has been established.

- Sellers can sell their seller financing note to investors who specialise in purchasing business notes, typically after the note has established a 6-12 month payment history.

- The sale of a seller note typically involves a discount on the remaining balance, with investors paying 70-85% of the outstanding principal.

- Understanding discount rates is crucial when selling a note, as investors calculate their return based on the risk profile of the note.

| Factors Affecting Note Sale Price | Impact on Sale Price |

|---|---|

| Interest Rate | A higher interest rate can increase the sale price. |

| Payment History | A reliable payment history can positively impact the sale price. |

| Security Provisions | Strong security measures can increase the attractiveness of the note to investors. |

To maximise the value when selling a note, sellers should ensure the original note includes transferability provisions and contains strong security measures.

Using Third-Party Loan Processors

Utilising a third-party loan processor can significantly simplify the management of seller financing arrangements. A loan processor handles all aspects of collecting, crediting, and disbursing monthly loan payments. As a neutral third party, they simplify the day-to-day management and process of managing loan payments.

Benefits of Professional Loan Servicing

The benefits of using a third-party loan servicer include professional servicing for seller financing arrangements. Key advantages are:

- Third-party loan processors provide professional servicing for seller financing arrangements, handling payment collection, processing, recordkeeping, and disbursement throughout the loan term.

- Using a loan servicer creates a professional buffer between buyer and seller, reducing potential conflicts and ensuring consistent administration of the loan according to the agreed terms.

- Professional loan processors maintain accurate records of all payments, automatically calculate interest and principal allocations, and provide regular statements to both parties.

The cost of loan servicing is typically modest, often between £25-75 per month, and can be paid by either party or shared. This provides significant value through professional administration and reduced risk of recordkeeping errors.

Common Mistakes to Avoid in Seller Financing

When engaging in seller financing, it’s crucial to be aware of the potential pitfalls that can jeopardise the sale of your business. Seller financing can be a viable option for small business sales, but there are common mistakes that sellers should avoid to ensure a smooth transaction.

One of the primary concerns is the risk associated with accepting a low down payment. We consider a low down payment to be anything less than 30% of the asking price. It’s suggested to ask for a down payment of at least 30% to 50% to minimise the risk and ensure the buyer is committed to making the business succeed.

For Sellers: Inadequate Due Diligence

Sellers frequently make the critical mistake of conducting inadequate due diligence on potential buyers. To avoid this, it’s essential to verify the buyer’s financial capacity, business experience, and credit history before agreeing to finance the sale.

- Sellers often fail to verify the financial capacity of potential buyers, increasing the risk of default.

- Accepting too small a down payment (less than 30% of the purchase price) significantly increases the seller’s risk exposure.

- Buyers may overextend financially by taking on seller financing with payments that consume too much of the business’s cash flow.

- Both parties frequently rely on poorly drafted or incomplete documentation that fails to address contingencies.

- Sellers sometimes neglect to include adequate security provisions in the financing agreement, making it difficult to recover their investment.

Conclusion

Seller financing is a valuable mechanism that can facilitate small business sales by providing a win-win situation for buyers and sellers alike. By allowing sellers to finance a part of the purchase price, it gives buyers confidence in the business’s potential, as the seller is invested in its success.

When structured properly, seller financing arrangements can create mutually beneficial scenarios. Sellers receive a higher purchase price and potentially beneficial tax treatment, while buyers gain access to financing that might otherwise be unavailable. The ability to charge interest on seller financing is essential to compensate sellers for the risk they assume.

To ensure successful seller financing arrangements, parties must pay careful attention to documentation, security provisions, and due diligence. Consulting with financial and legal professionals is advisable to ensure compliance with applicable laws and to meet specific needs.